Being the official export credit agency in Türkiye, Türk Eximbank helps Turkish companies engaged in goods and services exports, overseas contracting, and investment goods manufacturing and sales increase their share in international trade by extending them credit and credit insurance support.

Being a specialized bank in export financing, Türk Eximbank has embraced it as a primary goal to achieve its predefined targets associated with export finance rather than maximizing profit. However, care is taken to pursue policies that will safeguard a healthy financial structure in keeping with the responsibility of being a bank.

In 2022, Türk Eximbank carried on with the “Türk Eximbank Strategic Transformation Program” initiated in 2020 with the aim of more effectively supporting our country’s export strategies and flourish the foreign trade ecosystem in line with the worldwide best practices in collaboration with its stakeholders. Under this program, Türk Eximbank is transforming into a structure that proactively supports the exporters that generate high added-value for the national economy and pursue operations in line with our country’s export strategies. It also identifies the needs and obstacles of exporters and companies with export potential, expands its product and service array targeted at their needs, and improves exporters’ experience of making use of Türk Eximbank support schemes. The Bank’s Strategic Priorities within the scope of the Strategic Transformation Program have been defined as follows: SME Priority, Value-Added Export Priority, Collateral Diversity, Sectoral Focus, Focused Country Strategy, Digitalization, Broad Product and Service Array, Creation of a Stable Funding Structure, Field of Activity and Structuring, Competence Transformation, Institutional Relations and Communications.

STRATEGIC TRANSFORMATION PROGRAM

IN 2022, TÜRK EXIMBANK CARRIED ON WITH THE “TÜRK EXIMBANK STRATEGIC TRANSFORMATION PROGRAM” INITIATED IN 2020 WITH THE AIM OF MORE EFFECTIVELY SUPPORTING OUR COUNTRY’S EXPORT STRATEGIES AND FLOURISH THE FOREIGN TRADE ECOSYSTEM IN LINE WITH THE WORLDWIDE BEST PRACTICES.

In 2022, under the Strategic Priorities and Transformation Program:

- İhracatı Geliştirme A.Ş. (İGE) was established in 2021, which is co-owned by the Turkish Exporters Assembly (TİM) and Türk Eximbank and coordinated by the Ministry of Trade with the aim of facilitating particularly our exporter SMEs’ access to finance. İGE commenced operations on 1 March 2022. During 2022, Türk Eximbank disbursed credits amounting to TL 13.5 billion to more than 2600 exporter companies, 93% of them SMEs, under İGE guarantee. Furthermore, the Ministry of Trade, Türk Eximbank and İGE signed a protocol regarding Prefinance Support Program in 2022.

- Within the frame of Value Added Exports priority, “Exporter Performance Potential Model” was introduced upon reaching a consensus with the stakeholders. The said model started to be utilized in the disbursement of CBRT rediscount credits and exporter demands forwarded to İGE.

- Under the Credit Transformation Project, processes continue to be reviewed end-to-end taking best practices into consideration. At the same time, our rating models were reviewed with respect to the best practices in the sector, improvement areas were identified and steps were initiated for necessary revisions. During 2022, weight was given to digitalization and automatization efforts for improving/shortening analysis and allocation processes and for mitigating operational risks.

- Sustainability-themed syndicated loans were secured in keeping with our priority of Stable Funding Structure Creation and sustainability, which we have placed in the focal point of our strategy.

Projects falling under the scope of the Transformation Program will continue to be carried out in 2023.

Domestic Loans

Türk Eximbank supports exporters, export-oriented manufacturers, companies exporting FC-earning services, and international contractors/investors with short- and medium-long-term cash credit programs. The financing support that companies will need during the production process is extended both for pre-shipment and post-shipment periods through cash loans.

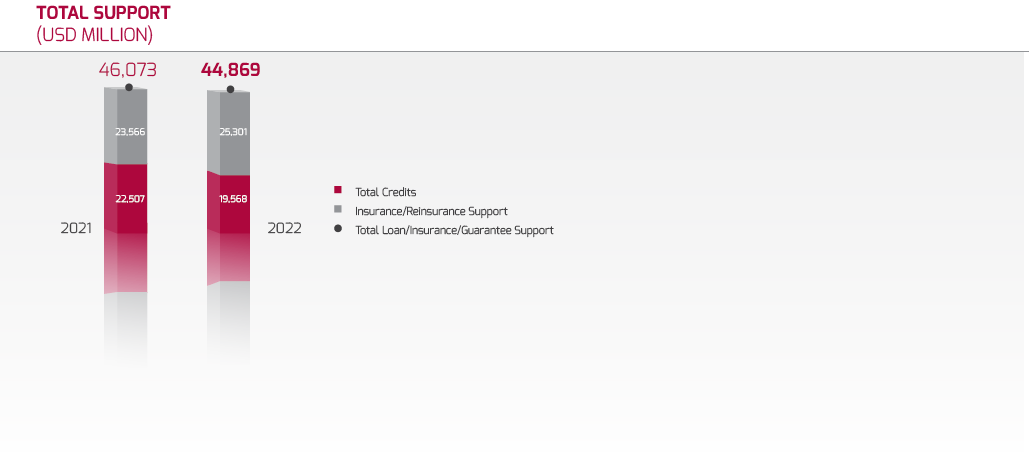

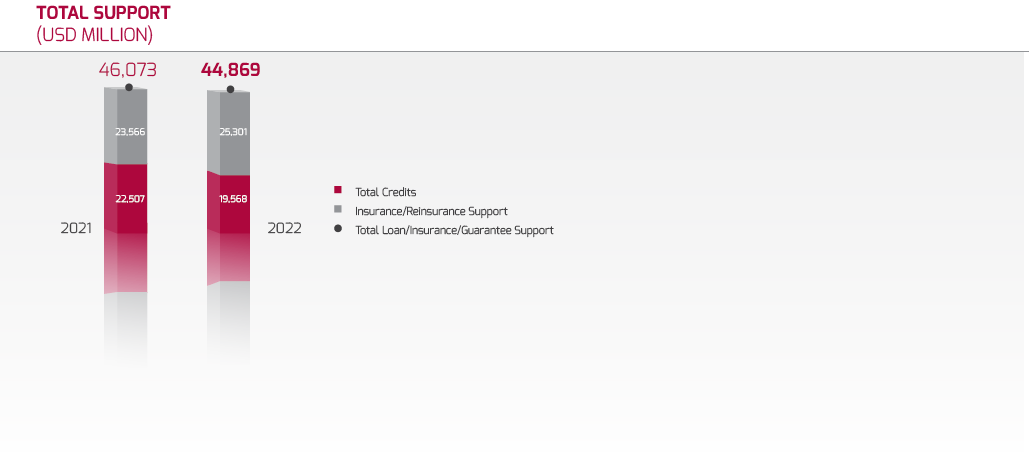

In 2022, short term loans extended by Türk Eximbank including maturity extensions totaled USD 17.7 billion, and medium-long term domestic loans totaled USD 1.7 billion.

USD 22.5 BILLION IN TOTAL

IN 2022, SHORT TERM LOANS EXTENDED BY TÜRK EXIMBANK INCLUDING MATURITY EXTENSIONS TOTALED USD 17.7 BILLION, AND MEDIUM-LONG TERM DOMESTIC LOANS TOTALED USD 1.7 BILLION.

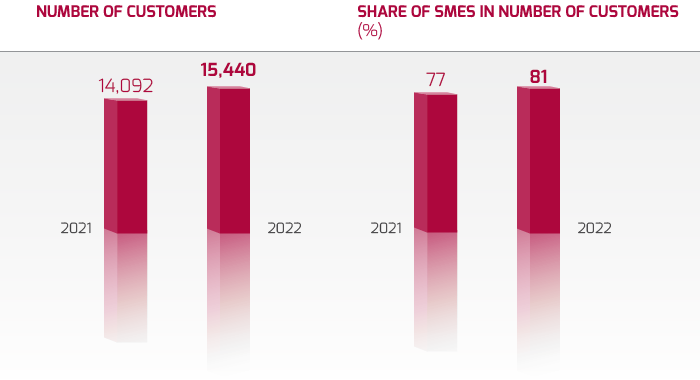

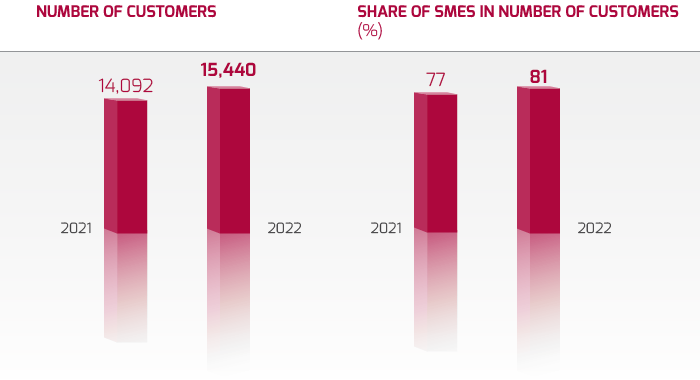

During 2022, 11,976 firms, which together accounted for a significant share of Türkiye’s total exports, benefited from Türk Eximbank’s loan programs.

Priority was given to SMEs in lending, and TL credits were predominantly used for SME financing. As a result of additional funds provided to the SMEs, prioritization of their credit requests, and term extension support offered, TL 46.7 billion in local currency and USD 844.6 million in foreign currency were allocated in the form of credit support, and total SME credits amounted to USD 3.6 billion. Accordingly, 18% of the Bank’s credit support were allocated to SMEs.

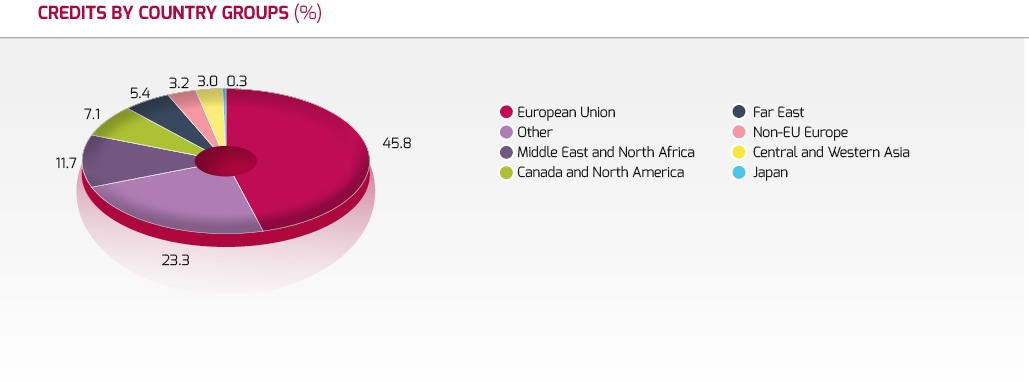

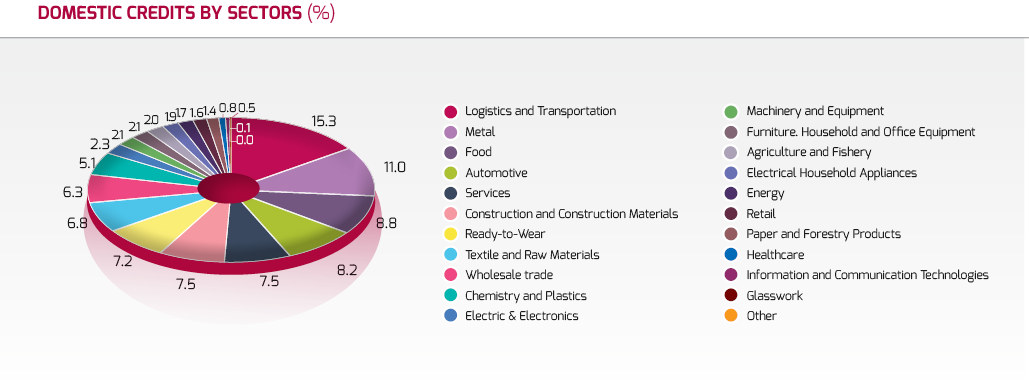

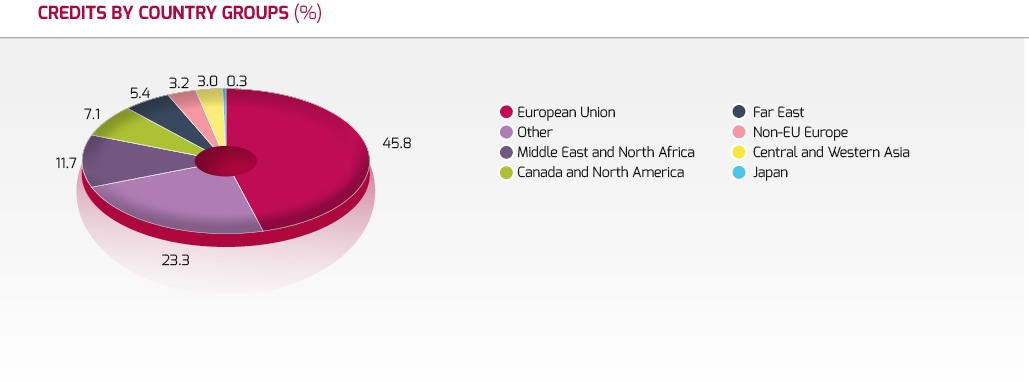

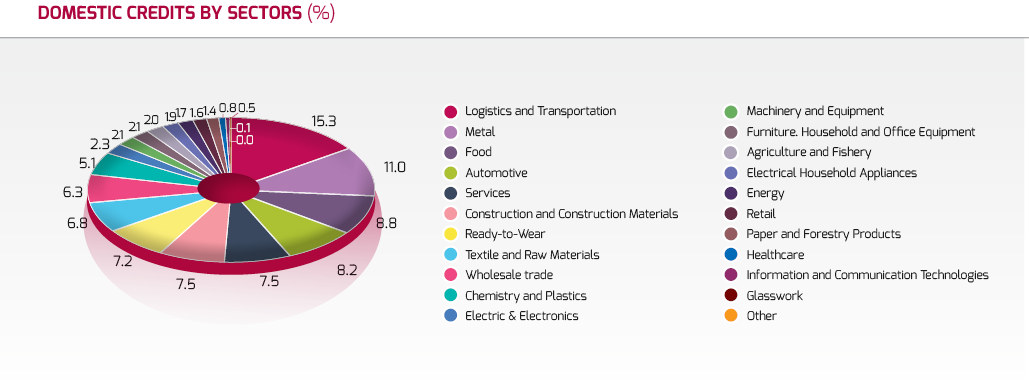

In the distribution of loans by country groups, EU countries led with 46% share. Logistics and transportation sector took the lead with 15% share in the sectoral distribution of loans.

Recent Adjustments and Changes in Domestic Credit Programs

- Maximum maturity for FC Pre-Shipment Export Credits was set as 720 days, and the application limit that was set as USD 1 million per transaction was lifted.

- Maximum maturity in TL Pre-Shipment Export Credits was set as 360 days, and the application limit per transaction was raised from TL 1 million to TL 20 million.

- In Pre-Shipment Export Credits disbursed via Participation Banks, the maximum terms were set as 360 days for TL loans and 540 days for FC loans.

- Web Application screens were launched, which will allow receipt of the application and analysis documents for companies that will make their first-ever credit application to our Bank, thus facilitating firms’ access to our Bank’s services.

- In addition to SMEs, non-SME firms wishing to borrow loans with İGE Equity guarantee began benefiting from Bank-sourced TL loans.

- As part of simplification and consolidation of our Bank’s documented credit procedures, Domestic Credit Policies, Domestic Lending Procedures and Loan Classification Policy documents were released, which are aligned with the current legislation and take into account the best practices in the sector.

- Under subparagraph (c) supplemented to Article 15.8 of the Capital Movements Circular, revenues derived on education, information, telecommunication, cloud and data center operation, entertainment and culture services rendered by resident persons to non-residents, and on car rentals to non-residents in foreign countries were included under the scope of foreign currency revenues, and rules were set regarding the eligibility of companies operating in the related sectors for benefiting from our Bank’s credit programs.

- Program limits applied on a company-basis in Bank-sourced loans were revoked.

- Post-Shipment Rediscount Credits, which were allocated with 180-day terms solely from out of CBRT funds for fulfilling exporters’ post-shipment financing needs, started to be allocated also from out of our Bank’s resources starting from September 2022 with maturities up to 360 days.

- İGE commenced operations on 1 March 2022 with the purpose of providing guarantee exclusively for export credits in favor of exporters in order to resolve credit guarantee problem that goods and services exporters frequently experienced in accessing financing. In line with the strategy of making exports broad-based, in 2022, more than 2,600 exporter companies, 93% of which were SMEs, were extended credits worth TL 13.5 billion against İGE guarantee co-founded by our Bank and the Turkish Exporters Assembly (TİM).

- The scope of the protocol signed with İGE was expanded in September, paving the way for non-SME companies to benefit from guarantee support. Furthermore, credit disbursement upper limits were significantly increased and the upper limits of lending to SMEs and non-SMEs were increased to TL 20 million and TL 30 million, respectively.

- Operating capital financing was provided to our exporters under the new guarantee fund allocated to our Bank under the Export Support Package on 10 March 2022 within the scope of Treasury-Backed CGF Guarantee.

- We have realized the first deal under the Rediscount Credit Based in Swap Agreements launched under CBRT Rediscount Credits in December 2022, which were introduced with the aim of increasing international competitive strength of manufacturers and manufacturer/exporter firms producing goods for export and firms undertaking FC-earning services and activities, and of fulfilling their need for financing during their preparation for exportation, and we completed our efforts to expand the credit facility in 2023. Rediscount Credit Based in Swap Agreements is a key product which is disbursed based on the swap agreement with the central banks of the People’s Republic of China, the Republic of Korea, United Arab Emirates and Qatar and the Central Bank of the Republic of Türkiye to be used in the payments related to the financing of commercial activities between the Republic of Türkiye and the said countries and which supports trade using local currencies.

- “Manufacturing Credit for Exporters Program” was launched, which will be financed by low-cost special funds to be secured from overseas financial institutions and export credit agencies with the aim of financing our exporters’ raw material, intermediate goods and investment goods procurement.

- Under the Overseas Letter of Guarantee Program, letters of guarantee were issued by non-resident banks with the counter-guarantee of Türk Eximbank, particularly as a result of the efforts spent for the shipbuilding industry in 2021, which helped increase additional business undertaking capacities of our exporter companies engaged in the shipbuilding industry, and support was extended to exportation of a fishing vessel to Norway and an all-electric towboat to Canada by two exporters. In addition to that, total support worth USD 15.9 million was made available under 5 different projects in response to letter of guarantee demands of our exporters engaged in the shipbuilding and construction contracting industries in 2022 under the said program.

Actualizations on the basis of Domestic Credit Programs (USD billion)

Direct Disbursements |

18.7 |

Bank-Sourced Loans |

3.1 |

CBRT-Sourced Loans |

15.6 |

Intermediary Bank/Institution Loans |

0.7 |

Loans Extended via Intermediary Banks/Financial Institutions |

0.7 |

TOTAL |

19.4 |

* A minimum portion of 30% of the credit lines allocated to intermediary banks must be disbursed to SMEs; accordingly, PSECs worth USD 0.6 billion were allocated to SMEs during 2022 (89%).

International Loans Programs

International Loans Programs, under which projects undertaken abroad by Turkish contractors and the buyers (public and private) of Turkish goods in foreign countries, are intended to increase Türkiye’s exports, diversify the goods and services exported, acquire new markets for export goods, increase the share exporters get from international trade, and provide competitive strength and assurance to Turkish firms in international markets. All supports provided under International Loans are in the nature of “buyer’s credits” and debtors are directly governments, the buyer country’s state-guaranteed public institutions or overseas/domestic banks within the allocated limits.

To add momentum to International Loans Programs and in turn, to increase exports of Turkish goods and services, revolving loan agreements are made with non-resident banks that the Bank deems reliable for overcoming the hardships borrowers experience in getting a state guarantee and for extending support to the private sector’s transactions, as well.

USD 158.6 BILLION

CREDITS DISBURSED UNDER THE INTERNATIONAL LOANS PROGRAMS AMOUNTED TO USD 158.6 BILLION

In this context, negotiations are ongoing for potential transactions within the frame of the credit lines allocated to three multinational banks (the African Export-Import Bank, ECOWAS Bank for Investment and Development (EBID), and the Eastern and Southern African Trade and Development Bank), as well as commercial banks operating in various countries.

The stagnation that resulted from the COVID-19 pandemic that took the whole world in a tight grip as of the first quarter of 2020 partially continued in 2022 although at a lessening degree; the war that broke out in February 2022 between Russia and Ukraine, our two important partners in trade which are our neighbors along the Black Sea, led to worldwide price increases particularly in energy and agricultural goods; the measures adopted by central banks that manage the reserve currencies for fighting the resulting inflation pushed interest rates up, which resulted in high borrowing costs throughout 2022 for developing countries that are more vulnerable as compared to developed economies. The interest rates offered to prospective borrowers under the International Loans Programs that were found to be high in conjunction with the elevated borrowing costs on one hand, and significantly restricted borrowing facilities available to countries our exporters and contractors pursue activities in under these countries’ agreements with international agencies resulted in limited buyer credit demands for overseas contracting and exports transactions. Despite all the negative circumstances mentioned above, credits disbursed under the International Loans Programs amounted to USD 158.6 billion.

Under the existing overseas bank analysis and credit line allocation methodology, a total credit line of USD 478 million was allocated to 12 banks, 3 of which are multinational banks. Hence, the transaction coverage expanded over 58 countries via the member countries of multinational banks.

Besides credit disbursements, letters of intent continued to be issued, which allow exporter companies and Turkish contractors to certify to their clients that they can take along Türk Eximbank financing particularly when developing business in risky markets and thus, contribute to their undertaking new projects abroad. During 2022, 26 Letters of Intent were issued for financing projects and goods exports planned to be undertaken by Turkish companies in a total of 18 countries in Africa, Asia and Europe. If the projects/transactions covered by the letters of intent provided to the firms are actually carried out, exports of goods and services from Türkiye is anticipated to amount to USD 2.6 billion.

In addition, our Bank participated in the meetings of the Environment Practitioners Group, Country Risk Experts, Technical Experts Group and Shipbuilding Working Group organized under the OECD, and made contributions for the formation of our country’s position and opinions.

Furthermore, the Bank took part in the 12th Development Plan Construction, Engineering/Architecture, Technical Consultancy and Contracting Services Special Expert Commission, Technical Cooperation and Development Aids and New Approaches to Multilateral Cooperation and Our Country’s Priorities working groups organized by the Republic of Türkiye Presidency of Strategy and Budget, and the Bank’s position, restraints and suggestions regarding the matters falling under its scope of duty were communicated.

Actualizations on the Basis of Projects/Deals under International Credit Programs

Within the scope of State-Guaranteed Buyer’s Credits, credit in the amount of USD 50 million was allocated in 2022 for various goods exports ex-Türkiye under the credit agreement for the amount of USD 200 million signed in 2018 between the Tunisian Ministry of Development, Investment and International Cooperation and our Bank, and the total amount of credits allocated so far reached USD 200 million.

During 2022, the amount of financing provided to buyers abroad of various goods and equipment exported from our country amounted to USD 135.7 million under State-Guaranteed Buyer’s Credits and USD 22.8 million under Buyer’s Credits Through Foreign Banks.

Within the frame of the Debt Service Suspension Initiative (“the Initiative”) launched by the Finance Ministers and Central Bank Governors of G20 countries with the aim of mitigating the effects of the Covid-19 pandemic on the poorest countries and freeing up these countries’ resources to be allocated for fighting the pandemic, deferment agreements were signed with the Congo party for their debt in the amount of EUR 28 million on 19 January 2022 and with the Djibouti party for their debt in the amount of USD 4.0 million on 21 March 2022. Under the Initiative, EUR 473 thousand for the Congo credit and USD 48 thousand for the Djibouti credit, which have become political risks, were recovered from the Republic of Türkiye Ministry of Treasury and Finance on 06 April 2022 and 23 May 2022, respectively.

On the other hand, USD 139.3 million has been collected from our debtors during 2022 within the scope of International Credit Programs.

Receivable Insurance

Türk Eximbank boasts being the entity that has initiated export receivables insurance in Türkiye and that has established awareness of the need for export insurance. Initially introduced to cover solely short-term export receivables against commercial and political risks, the export credit insurance system’s scope was broadened in time, and medium/long-term exports of goods were also included within insurance coverage with the Specific Export Credit Insurance Program.

Through its insurance programs, the Bank provides insurance coverage for exports to countries covered under the insurance against losses arising from commercial and political risks arising from the importer firm and importer’s country. In addition, domestic receivables of exporters are protected against commercial risks also through domestic credit insurance as well as export credit insurance.

Moreover, obtaining a credit from financial institutions is facilitated by putting up credit insurance policies as collateral.

USD 25.3 BILLION IN TOTAL

DURING 2022, SHIPMENTS WITH A TOTAL WORTH OF USD 25.3 BILLION WERE INSURED UNDER SHORT-TERM EXPORT CREDIT INSURANCE, SHORT-TERM DOMESTIC CREDIT INSURANCE AND MEDIUM-LONG TERM EXPORT CREDIT INSURANCE.

During 2022, shipments with a total worth of USD 25.3 billion were insured under Short-Term Export Credit Insurance, Short-Term Domestic Credit Insurance and Medium-Long Term Export Credit Insurance.

In 2022, reinsurance continued to be obtained from domestic and overseas companies for 60% of commercial and political risks (pertaining to OECD non-member countries) assumed within the frame of receivable insurance programs.

In 2022:

- Intended to indemnify direct production costs borne by firms in the event that the order cancellation risk exporters are confronted with during the production processes occurs, the Pre-Shipment Risk Policy was revised, under which it became possible to include under insurance coverage the pre-shipment production costs of the shipments the post-shipment period of which will be covered by the Short-Term Export Credit Insurance and Medium-Long Term Export Credit Insurance of the said Policy.

- Approval has been received from the Bank’s Advisory Committee regarding the Participation Finance-Based Receivable Insurance Program planned to be enforced by early 2023, the policy wording for the Program was prepared, and work was carried out for systemic improvements.

- Overseas Contracting Services Political Risk Policy was revised.

- Türk Eximbank Country Risk Classification (CRC) that is being used in the pricing of export credit insurance products, automatic credit line allocation and limit risk monitoring algorithms have been revised effective 1 December 2022.

- Actuarial advisory was received for development of risk-based pricing and discounting models.

- Work was carried out on automated credit line allocation system which will be used for short-term insurance programs with the aim of responding to exporters’ demands more quickly.

- Our Bank signed a protocol with Coface Servis Bilgi ve Danışmanlık Hizmetleri Ltd. Şti. for getting receivable collection service in relation to follow-up and collection of our Bank’s overseas indemnification receivables, under which collection service was started to be received from the said company.

- An informative announcement was made to insured companies regarding important considerations related to fraudulent commercial transactions confronted by our insured companies and our Bank, and a working group was set up to address actions/precautions that can be adopted by our Bank.

- Studies were carried out with two reinsurance brokerage firms regarding reinsurance optimization and alternative reinsurance techniques with the aim of building on our Bank’s knowledge about reinsurance and establishing the efficiency level of the existing reinsurance structure; additionally, work was initiated for engaging brokerage service for the signing of annual reinsurance treaties.

Short-Term Export Credit Insurance

The Short-Term Export Credit Insurance Program provides cover for all shipments of exporters up to 360 days against commercial and political risks.

Offered since 1989 by Türk Eximbank, Short-Term Export Credit Insurance became a service recognized and extensively used by exporters in time. As a result, 6,184 export firms were making use of the service as of 2022 year-end.

Under the program, exports worth USD 22.6 billion was provided with insurance cover in 2022, and premiums in the amount of USD 63.2 million were collected for the insured shipments.

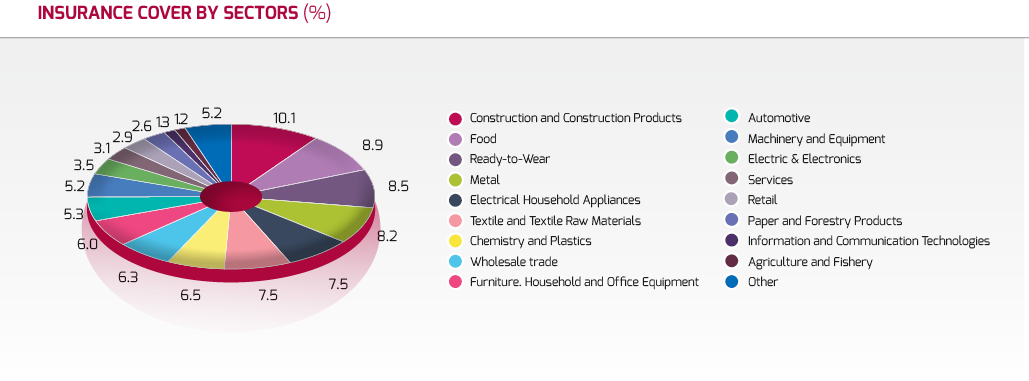

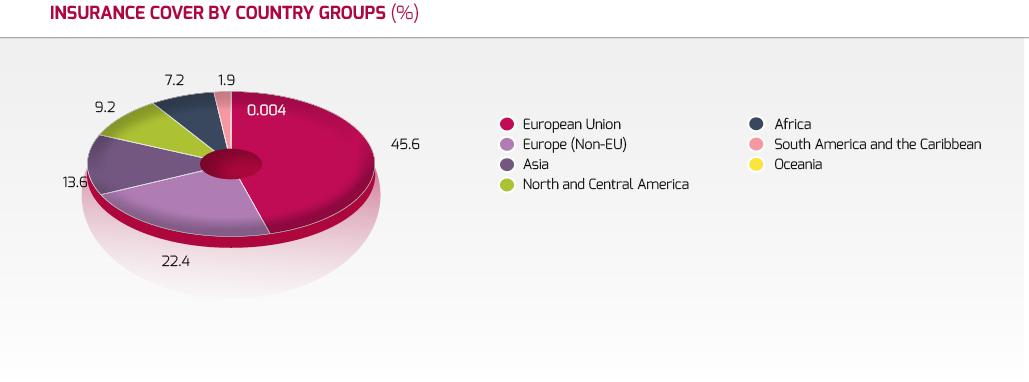

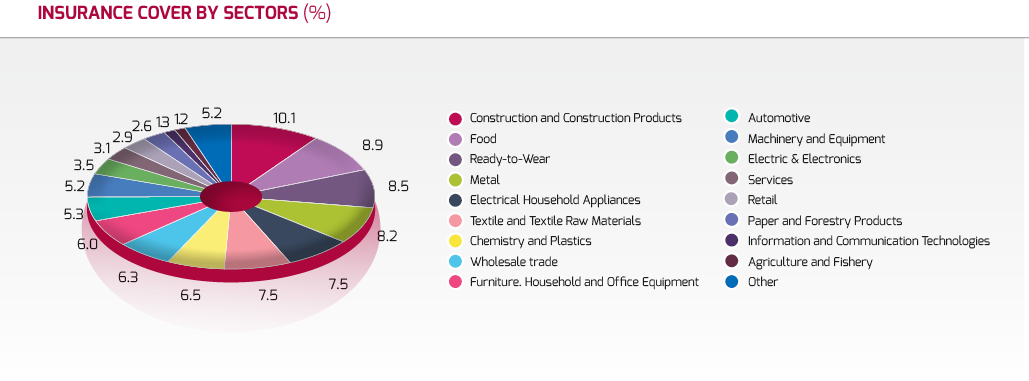

In the sectoral distribution of insured shipments, construction and construction products industry took the lead with 10% share, followed by food industry and metal, ready-to-wear and garment industry with 9% share each.

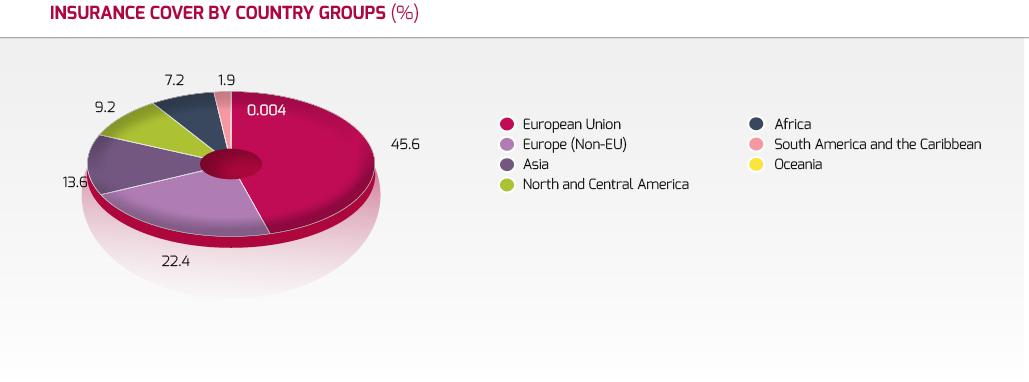

The regional distribution, however, is topped by European (European Union and non-EU combined) countries with 68% share, whereas Asia ranked second with 14% share and North and Central America ranked third with 9% share.

The number of buyers granted consistent limit under the Short-Term Export Credit Insurance Program is 53,066.

In 2022, Türk Eximbank indemnified USD 25.3 million in losses, which arose from shipments to various countries and the receivables from which could not be collected when due, under the Short-Term Export Credit Insurance Program. In the same period, Türk Eximbank recovered a portion of USD 5 million out of the losses indemnified before.

Financing can be obtained against Türk Eximbank insurance policy under the protocols signed with 20 banks. A total credit volume of approximately USD 192.1 million was created to date, with USD 20.1 million of it generated in 2022.

Short-Term Domestic Credit Insurance

Short-Term Domestic Credit Insurance program for exporters and their group companies is another area of insurance that Türk Eximbank is engaged in.

With this program, receivables of exporters and group companies having a Short-Term Export Credit Insurance Policy from credit-sale shipments up to 360 days, which are associated with their domestic operations, are insured against commercial risks within specified limits.

As of year-end 2022, 170 firms’ shipments worth USD 2.7 billion were insured. Premiums in the amount of USD 5.8 million was collected for the shipments insured, while claims paid amounted to USD 113 thousand.

Specific Export Credit Insurance

Exporters’ receivables arising from shipments born out of a single sales contract with a maximum term that is defined in line with OECD rules are provided coverage with Specific Export Credit Insurance. Under the program, sales through overseas subsidiaries can also be insured besides exports of Türkiye-origin investment goods and services of export companies.

Under the Specific Export Credit Insurance Program, insurance support provided during 2022 totaled USD 2.3 million in total.

Other Insurance Programs

Other insurance programs offered by Türk Eximbank are Pre-Shipment Risk Insurance, Financial Institutions Buyer’s Credit Insurance, Overseas Contracting Services Political Risk Insurance and Letter of Credit Confirmation Insurance programs.

Pre-Shipment Risk Insurance Program aimed at exporters provides insurance coverage for potential losses directly associated with production costs that an exporter might sustain in the event that the order is cancelled by the buyer during the production phase in connection with commercial and political risks. Overseas Contracting Services Political Risk Insurance Program aimed at contractors, on the other hand, provides insurance coverage for potential losses Turkish contractors may sustain in relation to their overseas projects as a result of political risks.

Financial Institutions Buyer’s Credit Insurance offered for banks provides insurance coverage for losses sustained by the creditor due to the borrower’s non-repayment of the buyer’s credits provided by domestic and overseas financial institutions for exportation of Turkish goods and services, whereas the Letter of Credit Confirmation Insurance Program insures losses sustained by the confirming bank in the event that letters of credit opened by an overseas issuing bank, to which the confirmation of a domestic bank is added, shall have not been paid by the issuing bank due to commercial and political risks.

Financing and Treasury

In 2022, Türk Eximbank secured funds in the amount of USD 2.2 billion from international markets and an additional USD 1.2 billion within the scope of funding from treasury transactions (repurchase agreements, TRS, money swaps, borrowings) and kept offering low-cost financing facilities with various maturities from its fund stock maintained at USD 7.9 billion level, excluding CBRT funds. The Bank’s total fund stock including TL credits and including the CBRT rediscount facility of USD 8.8 billion was registered in the order of USD 16.9 billion. On the other hand, principal repayment by the Bank amounted to approximately USD 3.5 billion during the reporting period.

USD 7.9 BILLION IN TOTAL

IN 2022, TÜRK EXIMBANK KEPT OFFERING LOW-COST FINANCING FACILITIES WITH VARIOUS MATURITIES FROM ITS FUND STOCK MAINTAINED AT USD 7.9 BILLION LEVEL, EXCLUDING CBRT FUNDS

Developments Regarding the Capital

As approved at the Extraordinary General Assembly convened on 12 January 2017, Türk Eximbank switched to the “Registered Capital System” in accordance with the Turkish Commercial Code no. 6102. The decision was registered with the trade registry and promulgated in the Turkish Trade Registry Gazette issue 9252 dated 30 January 2017.

As a result of the Bank’s Ordinary General Assembly convened on 14 March 2022, the Bank’s registered capital ceiling was increased from TL 17.5 billion to TL 30 billion.

Furthermore, the Board of Directors approved increasing Türk Eximbank’s fully paid-in capital of TL 10 billion 800 million by TL 3 billion to TL 13 billion 800 million, which incremental amount will be paid in cash by the Republic of Türkiye Ministry of Treasury and Finance on 29 December 2021, and the capital increase was consummated by being registered with the İstanbul Trade Registry on 3 February 2022, thereby preserving the Bank’s solid capitalization.

Borrowing Transactions

TL funds derived within the scope of paid-in capital and interest collections were used for funding almost the entirety of TL loans disbursed in 2022, excluding Rediscount Credits.

The details about the Bank’s borrowings in 2022 are presented below:

- Türk Eximbank heavily utilized the promissory note rediscount facility of the Central Bank of the Republic of Türkiye (CBRT). As of 31 December 2022, the balance of these resources including TL Rediscount Credits amounted to USD 8.8 billion.

- Türk Eximbank renewed the Bank’s first-ever sustainability-linked deal with a rollover ratio of 104% in May, which was participated by 26 international financial institutions, and raised a 1-year facility for EUR 504 million and USD 205,8 million for a total fund of USD 745 million. In November, the Bank renewed its syndicated loan, again linked to sustainability criteria, with a rollover ratio of 101.4% and raised USD 588 million in total under a 1-year term facility comprised of EUR 404.2 million, USD 136 million and CNY 350 million.

- A murabaha fund, i.e. cost-plus method, in the amount of USD 55 million was secured on 9 June 2022 as the second tranche of the USD 100 million loan agreement signed with the Islamic Development Bank (IDB) on 6 May 2020 under the guarantee of the Republic of Türkiye Ministry of Treasury and Finance.

- The amount of loans secured from international banks totaled USD 797.1 million in 2022

Furthermore, the Bank secured USD 1,223 million in funds secured through treasury transactions (repurchase transactions, TRS, currency swaps, borrowings). As at year-end 2022, the existing fund stock is in the order of USD 397.7 million.

Fund Management Activities

Türk Eximbank kept a close eye on national and global developments, and paid maximum attention to liquidity, interest rate and exchange rate risks management, taking into account such issues as interest and exchange rates, global macroeconomic conjuncture, and return-cost balance in 2022.

As part of liquidity management, funds generated through currency swap, repo transactions and borrowings from money markets were invested in CBRT, Takasbank Money Market and interbank market, and high interest income was achieved. The liquidity ratio in total assets managed by the Treasury Department, which was kept within the legal limits set out in the BRSA Regulation Concerning Measurement and Evaluation of Liquidity Adequacy of Banks, averaged 6.1% throughout 2022, and the share of securities portfolio in total assets was 3.9% in average.

In the reporting period, the Bank carried on with short- and long-term swap operations for cash flow management and assets and liabilities harmonization purposes. Türk Eximbank’s swap operations in 2022 aimed at managing the Bank’s FX position and cash flows more effectively and ensuring asset-liability harmony, as well as for arbitrage purposes, were worth USD 23.5 billion, of which USD 23.2 billion was in short-term and USD 300 million was kept in long-term.

Hedge accounting continued to be implemented in order to prevent fluctuations on the income statement resulting from interest and cross-currency swaps carried out for harmonizing FC funds secured from international markets through bond issuances or other borrowings with the assets composition.

Derivatives (forwards, options and swap transactions) continued to be offered with the purposes of protecting exporters’ competitive strength in global markets, and strengthening their ability to manage the exchange rate risk stemming from FC receivables and FC liabilities and the interest rate risk that might arise from interest rate fluctuations. Derivatives based on commodities/precious metals started to be offered to exporters.

International Relations

CLOSE COOPERATION

TÜRK EXIMBANK CONTINUED TO COOPERATE CLOSELY WITH EXPORT CREDIT AND INSURANCE AGENCIES AND INTERNATIONAL FINANCIAL INSTITUTIONS IN 2021.

There are over fifty agreements of various content that Türk Eximbank signed with the export credit and insurance agencies of more than thirty countries, as well as multilateral financial institutions. The Bank sustained its close cooperation with these institutions and its efforts for signing new agreements also in 2022.

Within this framework, Memoranda of Understanding (MoU) were signed for general cooperation and cooperation in third countries with SERV (Switzerland), ETIHAD (United Arab Emirates) and Saudi Exim (Saudi Arabia) in 2022. In addition, agreement was reached on the wordings of a general MoU signed with Pakistan Eximbank, Pakistan’s newly established official export credit agency, and an MoU for specific cooperation that will enable fulfillment of Turkish companies’ demands for letters of guarantee they need for shipbuilding with Eksfin, Norway’s official export credit agency. Steps will be taken to consummate these MoUs in 2023, which could not be signed in 2022.

In 2022, work continued to add new ones to the reinsurance agreements signed in earlier years with USEXIM (USA), UKEF (UK), BPIFrance (France), EKF (Denmark), OeKB (Austria), MEHIB (Hungary) and EKN (Sweden) to enable co-financing of projects that Turkish exporters and contracting firms will undertake in third countries in cooperation with foreign firms, and thus, contribute to increase their competitiveness.

Türk Eximbank continued to attend the meetings of OECD Export Credits and Credit Guarantees Group, which was established to facilitate information and opinion exchange between member countries’ related institutions regarding officially supported export credits and of which Türkiye became a permanent member in April 1998.The Bank participated in the negotiations for updating the Arrangement on Officially Supported Export Credits which is addressed in the meetings of OECD’s Participants to the Arrangement on Officially Supported Export Credits, within which the Bank acquired “invited participant” (observer) status in 2006 and “participant” status in 2018, and which is important for setting the minimum requirements for export credits to be provided by Participant countries. Being a member of the Berne Union (the International Union of Credit and Investment Insurers), Aman Union (DHAMAN [The Arab Investment and Export Credit Guarantee Corporation] and Commercial & Non-commercial Risks Insurers & Reinsurers in Member Countries of Organisation of Islamic Cooperation), AEBF (Asian Exim Banks Forum) and ADFIMI (Association of National Development Finance Institutions (DFIs) in Member Countries of the Islamic Development Bank (IDB)), Türk Eximbank participated in the said associations’ meetings, seminars and workshops held in 2022. Berne Union’s Spring Meeting 2022 took place in İstanbul and was hosted by our Bank. The Bank attended and contributed to the meetings of Berne Union and Aman Union, on the Executive Committees of which our Bank sits as a member, which were held for the establishment of their strategies and goals for the coming period.

Turk Eximbank was involved in the drafting of the “Joint Statement on Financial Support to Green Development”, which was prepared for being signed at the conclusion of the Annual Meeting of the Asian Exim Banks Forum held in Malaysia in 2022. The Bank made the necessary contributions to the statement, of which it is a signatory.

At the ADFIMI General Assembly Meeting held in Egypt, Turk Eximbank was elected as a member of the Audit Board for a three-year term of office.

In response to the demands voiced in intergovernmental meetings or conveyed directly to Türk Eximbank, seminars allowing information and experience sharing were organized to brief the representatives of Sanoatsodirotbonk based in Tajikistan and member banks of Azerbaijan Banks Association, which paid a visit to our Bank in 2022, about our Bank’s activities.

Information Technology

Türk Eximbank continues to ensure both speed and productivity and to efficiently use resources by backing its service infrastructure with new technologies in the light of the advances in information technology.

Our facilitative projects that will fulfill our exporters’ needs were put into life

Türk Eximbank added speed to its electronic transformation processes and carried out the following as part of its internal and external digitalization efforts:

Lending processes were integrated with İhracatı Geliştirme A.Ş. (İGE), which was established to provide guarantee support to our exporters, thus increasing the diversity of guarantees on offer.

İHRACATI GELİŞTİRME A.Ş.

LENDING PROCESSES WERE INTEGRATED WITH İHRACATI GELİŞTİRME A.Ş., WHICH WAS ESTABLISHED TO PROVIDE GUARANTEE SUPPORT TO OUR EXPORTERS, THUS INCREASING THE DIVERSITY OF GUARANTEES ON OFFER.

Support was extended to Main Banking application work; the Bank Analysis module was upgraded and put into use.

Information Systems investments were made and work on UX design was initiated for Internet Branch and Mobile Branch screens. KKB (Kredi Kayıt Bürosu / Credit Bureau of Türkiye) and RM (Risk Merkezi / Risk Center) integrations were improved, and operational processes were digitalized to upgrade Financial Analysis and Limit Allocation processes.

Upon creation of the infrastructure that will make the basis of early warning and monitoring systems through the steps taken last year for external company integrations as part of financial analysis and credit information process digitalization; Domestic Scoring Model system development was completed and the model was developed so that it can be used also in credit allocation processes, thereby allowing generation of Credit Information and Analysis Reports entailing credit ratings by the system. Furthermore, Early Warning System modelling project was initiated within the scope of the Credit Transformation Project.

SWIFT Integration project was brought to completion, which will allow making the SWIFT Payment Systems at our Bank more systematic and centralized and will pave the way for increased effectiveness of our external transactions payment systems, in particular.

System development was finalized, which will enable shipment data shared under the protocol signed by and between the Ministry of Trade and our Bank for data sharing to be used in our Bank’s processes so as to alleviate the operational workload entailed in our Bank’s shipment notification and processing both for customers and business units and to enable accessing healthier data in reporting.

In addition to the above;

- Architectural design of the desktop and application virtualization system infrastructure was made and installation was initiated.

- Bank Business Continuity testing was carried out throughout the year, and work was undertaken regarding compliance with the ISO 27001 Information Security Management System Standard and the Regulation on Banks’ Information Systems and Electronic Banking Services.

- Significant IT-related findings from Independent Audit, Internal Audit and Information Security Vulnerability (Penetration) Tests were remedied.

- Within the scope of sustainability compliance efforts, printers were configured for joint use at the Head Office location, and the implementation will be further rolled across Districts and Branches in 2023.

- Disbursement, collection and other processes of country loans within the scope of State-Guaranteed and Buyer’s Credits Through Foreign Banks Programs continued to be improved using new technologies.

- Asset Backed Securities (ABS) Issuance Turkey Securitization Company (TSC) Data Transfer project was brought to completion, which enables preparation of electronic book of guarantees and investor reports to be used in issuing our Bank’s ABS.

- RPA (Robotic Process Automation) was put into pilot run so that certain tasks in our Bank’s operational processes will be handled by robot software, increasing the productivity of our Bank’s workflow.

- Within the scope of IT trail logging and security warning system infrastructure upgrade, Log Management and Correlation application was procured, and system integration was completed during 2022.

- Servers and storage systems started to be updated with the aim of maintaining an effective business continuity model at the Bank by minimizing current/potential risks by securing systems redundancy for the banking system infrastructure, and associated data volume.

- In view of the global change in variable interest rates; our Bank’s systems were readied for the GBP SONIA and USD SOFR data extraction in line with the practices announced by the financial authorities and/or those resulting in the market from common practices and in accordance with the transition schedules with the LIBOR – TLREF transition.

International Obligations

Work is ongoing to harmonize Türk Eximbank programs with WTO, OECD and EU guidelines, and these rules are taken into consideration in the programs implemented.

International Rules

In the programs it implements, Türk Eximbank must comply with the norms of the World Trade Organization (WTO), the OECD and the EU, as well as with other international regulations in connection with Türkiye’s obligations in relation to its membership of the WTO, the OECD ECG and OECD Participants Group, and in relation to the agreement of the Customs Union and the EU accession process. Accordingly, work is ongoing to harmonize Türk Eximbank programs with WTO, OECD and EU guidelines, and these rules are taken into consideration in the programs implemented.

In 2022, the Bank continued to attend the meetings of OECD Export Credits Group (ECG) which aims to evaluate policies, identify problems and provide solutions by multilateral discussions on export credits, and closely monitored the developments. In all of its practices, the Bank adheres to the three recommendations that emerged from the studies at these meetings, i.e., OECD Recommendation on Bribery and Officially Supported Export Credits, Recommendation on Environment and Social Due Diligence and Recommendation on Sustainable Lending Practices and Officially Supported Exports Credits.

Upon our country’s acquisition of Participant Status in the PG in 2018 where it was an “Invited Participant” (observer) since 2006, it has become part of the decision mechanism for revisions to the OECD Arrangement that sets the rules governing officially supported export credits with maturities over two years provided by the member countries, and all rules associated with export credits became binding upon Türk Eximbank as well.

WTO, OECD AND EU GUIDELINES

WORK IS ONGOING TO HARMONIZE TÜRK EXIMBANK PROGRAMS WITH WTO, OECD AND EU GUIDELINES, AND THESE RULES ARE TAKEN INTO CONSIDERATION IN THE PROGRAMS IMPLEMENTED.

Harmonization with the EU Acquis

The Bank’s activities are covered under the “Competition Policy” and “External Relations” chapters of the EU Acquis, with which harmonization is to be achieved.

Pursuant to an EU rule, which states that marketable risks associated with short-term export credit insurance must be incurred by entities that do not receive governmental assistance, all of the Bank’s short-term insurance activities will need to be organized under a separate entity within the frame of harmonization efforts with the EU Acquis. With respect to restructuring activities that will come up within the frame of the said EU Directive, it is anticipated that a joint project with all stakeholders will take place in accordance with the instructions of the Ministry of Treasury and Finance.

With respect to the “External Relations” chapter, medium and long term financial supports to be provided by the Bank have been aligned to a large extent with the EU Acquis, which includes OECD Regulation on Officially Supported Export Credits, following the participant status acquired by Türkiye in relation to the said Regulation in 2018.