2023 Actuals on the Basis of Domestic Lending Programs (billion USD) |

|

Direct Lending |

19.1 |

Bank-Sourced Loans |

6.6 |

CBRT-Sourced Loans |

12.5 |

Intermediary Bank/Institution Loans* |

0.5 |

Total |

19.6 |

* A minimum of 30% of the lines allocated to intermediary banks must be disbursed to SMEs. Accordingly, SMEs were extended loans in the amount of USD 0.493 billion via intermediary banks in 2023 (91%).

Total volume of the Bank’s domestic lending in 2023 including maturity extensions split as USD 16.3 billion short-term loans and USD 3.3 billion medium-long term loans.

During 2023, 13,167 companies benefited from Türk Eximbank’s credit programs. Prioritizing SMEs that act as the engine of the Turkish economy in its lending activities, Türk Eximbank allocated 25.31% of the credit facilities mostly constituted by TL loans to the SMEs.

In 2023, SMEs were disbursed TL 98.8 billion and USD 902.6 million in loans, and total SME lending reached USD 5 billion.

Attaching importance to supporting women entrepreneurs, Türk Eximbank provided a financing of USD 740 million to exporters in this segment sourced from the CBRT, Eximbank and associated funds in 2023.

Türk Eximbank discounts its export receivables with the aim of increasing export volume by encouraging exporters’ forward sales transactions, and facilitating their penetration to new and target markets.

Marketing activities are ongoing for the “Manufacturing Credit for Exporters Program”, which will be financed by low-cost special funds to be secured from overseas financial institutions and export credit agencies with the aim of financing exporters’ raw material, intermediate goods and investment goods procurement.

In the aftermath of the earthquakes that occurred in our country on 6 February 2023 and caused excessive damage, Türk Eximbank undertook significant efforts to help relieve the losses. To this end, the Bank:

Furthermore, Türk Eximbank plans to sign a funding agreement for USD 100 million with the Asian Infrastructure and Investment Bank (AIIB) for medium/long term financing of investment needs of exporters who were affected by the earthquake in 2024.

Under the existing overseas bank analysis and credit line allocation methodology, as of the end of 2023 a total credit line of USD 422 million was allocated to 8 banks, 2 of which are multinational banks. Hence, the transaction coverage expanded over 54 countries via the member countries of multinational banks by the end of the year.

The loans disbursed under International Loans Programs in 2023 amounted to USD 46.8 million, and repayments collected from debtors totaled USD 138.3 million.

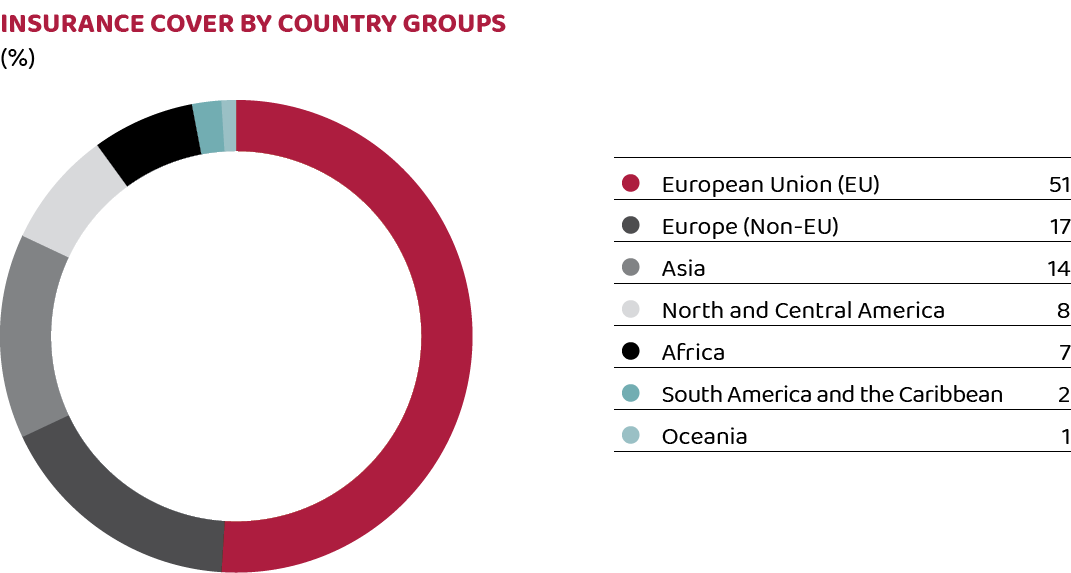

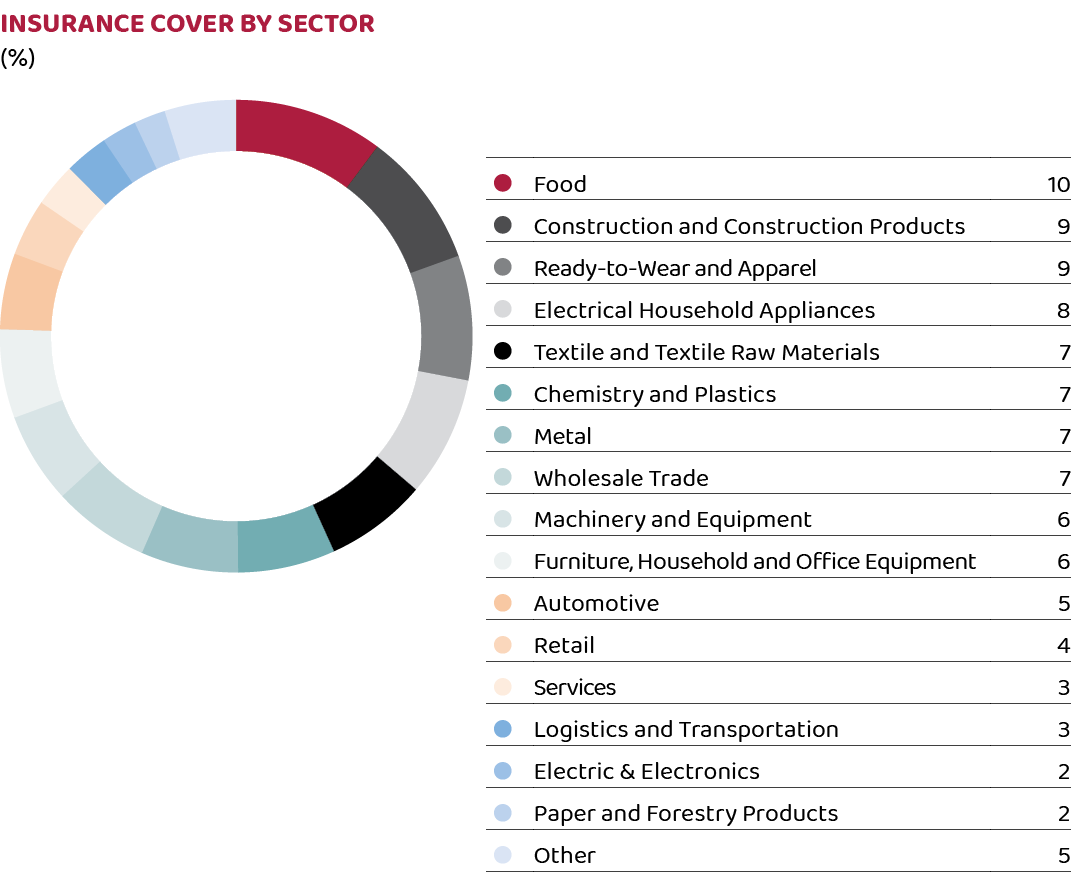

During 2023, shipments worth USD 22.4 billion were covered under Türk Eximbank’s Short-Term Export Credit Insurance, Short-Term Domestic Credit Insurance and Specific Export Credit Insurance programs.

Under the short-term export credit insurance program, exports worth USD 19.7 billion was provided with insurance cover in 2023, and premiums in the amount of USD 64.9 million were collected for in-scope shipments.

53,190 buyers were granted a limit under the Short-Term Export Credit Insurance Program that is commonly used by exporters, and 6,857 companies benefited from the program as of year-end 2023.

In 2023, Türk Eximbank indemnified USD 24.9 million in losses, which arose from shipments to various countries and the receivables from which could not be collected when due, under the Short-Term Export Credit Insurance Program. In the same period, Türk Eximbank recovered a portion of USD 6 million out of the losses indemnified before.

Within the scope of the short-term domestic credit insurance program that entails all credit-sale shipments up to 360 days, which are associated with domestic operations, 159 firms’ shipments worth USD 2.7 billion were insured as of year-end 2023. Premiums in the amount of USD 6.3 million were collected for insured shipments, while claims paid amounted to USD 35 thousand.

There are over 60 agreements of various content that Türk Eximbank signed with the export credit agencies of 40 countries, as well as multilateral financial institutions. The Bank sustained its close cooperation with these institutions and its efforts for signing new agreements also in 2023.

OECD Arrangement on Officially Supported Export Credits

Türk Eximbank is a member of the OECD’s Working Party on Export Credits and Credit Guarantees and OECD’s Participants to the Arrangement on Officially Supported Export Credits, and hence, takes part in and contributes to the activities of these groups.

In 2023, the Bank took part in the negotiations held for the OECD Arrangement on Officially Supported Export Credits. The meetings resulted in flexible solutions that will allow expanding the scope of climate-friendly projects that can be supported and implementation of longer terms. Moreover, the report regarding how member countries implement OECD Recommendation on Environmental and Social Due Diligence, together with suggested revisions to the Recommendation was approved by the Working Party on Export Credits and Credit Guarantees.

Participation in Africa Finance Corporation as a Shareholder

Türk Eximbank signed a shareholding agreement with Africa Finance Corporation (AFC), one of Africa’s most important multilateral financial institutions, for a 3.25% stake in the company, thus, becoming the first non-African shareholder in the continent’s leading provider of infrastructure solutions.

Representing Türk Eximbank’s first-ever shareholding in an international institution, this strategic partnership is targeted to lend contribution to increase the presence and contract undertaking capacities of Turkish exporters and contractors in the region, particularly in AFC-member 42 African countries.

Sustainability-linked Syndicated Loans

With the sustainability-linked syndicated loan deal carried out in May 2023, Türk Eximbank secured a fund with a 1-year maturity in the total amount of USD 674 million, which consists of EUR 522 million, USD 54 million and CNY 325 million and which was participated by 24 international banks.

In November 2023, the Bank renewed the syndicated loan -again tied to sustainability criteria- with a roll-over ratio of over 100%. Under the deal participated by 21 international banks, Türk Eximbank obtained a 1-year financing of USD 658 million in total, which consisted of EUR 496.2 million, USD 79 million and CNY 350 million.

Performance criteria of both facilities include credit disbursement to women entrepreneurs and SMEs exporting green products, particularly those located in the earthquake-hit region.

In addition, in August, Türk Eximbank secured a USD 277 million-fund with a one year maturity under the murabaha syndicated loan agreement coordinated by the Islamic Trade Finance Corporation (ITFC),a member of the Islamic Development Bank (IsDB) Group. The deal was given the “Trade Finance Deal of the Year” award at the IsDB Group’s Private Sector Forum.

Borrowings from International Capital Markets

Funds worth approximately USD 2 billion were obtained from international capital markets on the back of Eurobond deals whose issuances were completed in January and October 2023 and private placements.

Other Activities in 2023

Information Technology

Türk Eximbank takes on activities that build on its competencies in line with the technological advancements introduced by the digital era, and continues to achieve speed and productivity and use resources effectively by backing its service infrastructure with new technology.

In 2023, the Bank added momentum to its electronic transformation processes and implemented several projects that will fulfill and facilitate exporters’ needs.

In this context, lending processes were integrated with İhracatı Geliştirme A.Ş. (İGE) incorporated for providing surety support to exporters, and the guarantees offered to exporters were further diversified.

Phase 1 of the Internet and Mobile Branch Revamping Project was launched in 2023. Within the scope of Phase 1, Internet and Mobile Branches were redesigned, credit and insurance main pages were created, and notifications were collected under a single menu. The new design that provides ease of use served to improve exporter experience and enhance exporter satisfaction. Infrastructure upgrading activities will continue in 2024.

According to digital activity criteria of the Banks Association of Türkiye (BAT), Türk Eximbank has 9,007 active digital companies and 12,245 active digital users that have signed in and completed a transaction at least once as of the fourth quarter of 2023.

Digitalization Projects in 2023 |

||||

Business Process |

Sub-Process |

Project Status |

Beneficiary Stakeholder |

Scope |

Credit |

Credit Transformation Process |

Completed |

Employees, Exporters |

Credit processes were optimized, resulting in increased productivity and speed, thus enhancing exporter experience. |

Data management mechanism was created and integrated data infrastructure was established. |

||||

Insurance |

Insurance Enhancement Process |

Completed |

Employees |

Manual processes were automatized, operational risks were eliminated and allocation durations were shortened. |

Fraud attempts can now be detected and prevented. |

||||

Online Banking |

Internet and Mobile Branch Project |

In Progress |

Exporters |

New functions were added to insurance and credit menus, and transaction sets were simplified. |

Digital Application |

Supplier Portal Project |

Completed |

Employees, Suppliers |

Using EXİMBUY, purchasing can be made online. |

HR Systems Project |

Completed |

Employees |

The new HR portal “Humanist” enables management of leave, overtime, personnel information, remuneration portal and support services on a single module. |

|

Reporting |

Internal Audit and Internal Control Project |

Completed |

Employees |

Effectiveness of internal audit and internal control activities at the Bank was increased, and audit and control activities can now be monitored via the system. |

Business Continuity Activities in 2023

Main banking database, server, data storage and backup systems were upgraded to capture the advancements in technology as part of Business Continuity activities. Furthermore, physical server environments were migrated to the virtualization platform for operational efficiency and energy efficiency purposes, which resulted in a virtualization ratio of 98%.

Initiatives Undertaken

Bank Business Continuity testing was carried out throughout the year, and work was undertaken regarding compliance with the ISO 27001 Information Security Management System Standard and the Regulation on Banks’ Information Systems and Electronic Banking Services.

Robotic Process Implementations

Targeting to alleviate the operational load on business units with the use of robotic technology, Türk Eximbank identifies transactions that cause this workload and includes them in robotic implementations. The Bank aims to have recurrent, unchanging transactions with clear-cut rules to be carried out by digital workforce, which are currently performed by employees.

In line with this, 14 processes were taken to RPA (Robotic Process Automation) environment so that certain tasks in our Bank’s operational processes will be handled by robot software, increasing the productivity of our Bank’s workflow.

As was the case in 2023, Türk Eximbank intends to use, upgrade and broaden robotic process implementations also in the future.

The Information Security unit that reports to the General Manager is responsible for monitoring and handling information security practices at Türk Eximbank.

To protect the Bank’s data and systems against unauthorized access, breaches and threats, necessary security measures are in place, such as encryption, access controls, security protocols and monitoring activities.

In view of the ever-increasing complexity and frequency of cyber threats, information security becomes a fundamental element of the Bank’s business strategy. To this end, necessary integration work is underway for aligning information security activities with the business goals. In this context, the Bank aims to make sure that information security is espoused as corporate culture with all its aspects such as network security, change management, front-end and back-end security, data protection, regulatory compliance, incident response and security awareness training.

Within the frame of Security Operation Center activities, measurements such as security incidents, security vulnerability remedy rates and compliance with security standards are regularly reported to the Bank management and related stakeholders.

Security controls are constantly reviewed and monitoring capability is increased through new tools for detecting vulnerabilities on the back of the work undertaken across the Bank. Security Information and Event Management (SIEM) tool is kept up-to-date to establish a modern Security Operation Center infrastructure.

Within this scope, various restrictive, monitoring and preventive activities were carried out in 2023, including, in particular, collection of security and event-based logs, creation and monitoring of correlations/alerts, data leakage and classification, access tracking and approval.

A close eye is kept on addressing the vulnerabilities identified as the result of scans performed and timely action-taking. Work was undertaken to protect the Bank’s information and data by way of periodic controls and instant responses.

Technology Risk Management and Counter-Measures Adopted

In addition to the internet and mobile banking channels that it has made available for use by exporters in line with its expanding business volume and digitalization initiatives, Türk Eximbank assigned borrowing accounts to each exporter for holding their liquid assets equivalent to their respective credit risks, and perform their FC buying/selling, payment and transfer transactions.

Due to these developments, anti-fraud efforts gained importance for protecting the Bank and exporters from malevolent third parties. To this end, scenarios were created for detecting out-of-the ordinary, counterfeiting or fraudulent banking transactions based on examples from the sector and Bank-specific transactions, and these scenarios started to be followed up through internal developments.

The “Data Sharing Inventory” created in 2022 to keep data sharing under control was upgraded in 2023 and vested in a simpler and more structured format.

Data shared with third parties are reported to the Banking Regulation and Supervision Agency at certain intervals as per the regulation.

Türk Eximbank’s bond issuance by early 2023 received “Quasi-Sovereign/GRE Bond Deal of the Year” award at the “Bonds, Loans & ESG Capital Markets CEE, CIS & Türkiye Awards”, a prestigious and respected recognition program in the finance sector organized by the GFC Media Group.