Considering environmental, social and governance (ESG) issues as the building blocks of its sustainability strategy, Türk Eximbank benchmarks its initiatives in this department against international norms and practices and the regulation in force in Türkiye.

It is no longer a matter of choice for businesses to work with a sustainable business model in the rapidly changing world that is confronted and forced to deal with numerous issues from climate change to socioeconomic inequality. In order to identify and manage their risk exposure, organizations are compelled to take into account financial and non-financial matters when developing their business models and strategies.

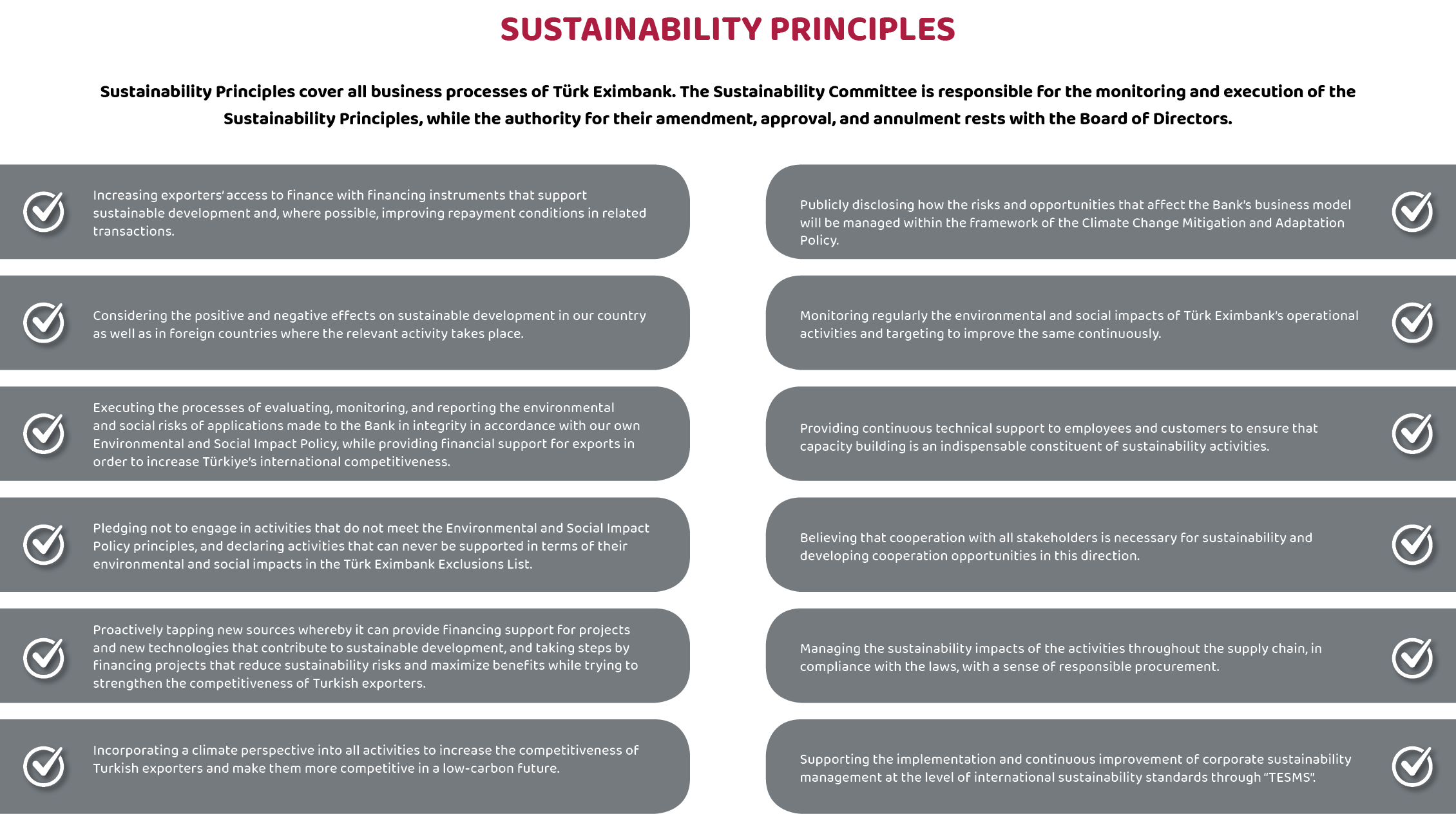

Based on this material fact, Türk Eximbank launched the “Sustainability, Environmental and Social Risk Management System” Project in 2019 to carry out all its activities in line with sustainability principles and to shape its governance structure on the center of these principles, and established its processes accordingly.

Steps continue to be taken in relation to the Sustainability Management System to assess environmental and social risks of the Bank’s lending and insurance activities and to guarantee that the same are effectively managed in line with the Bank’s strategy.

When evaluating the transactions to be supported, Türk Eximbank prioritizes environmental and social awareness, human rights and work ethics criteria and takes as the basis the principles included in the Environmental and Social Guidelines prepared pursuant to the Recommendation of the Council on Common Approaches for Officially Supported Export Credits and Environmental and Social Due Diligence” (The “Common Approaches”).

Türk Eximbank Environmental and Social Practice Guidelines can be reached at:

When assessing direct or indirect environmental and social impacts in all its operations, Türk Eximbank considers internationally accepted standards and principles, some of which are specified hereinbelow:

In 2023, Türk Eximbank conducted environmental and social risk assessment for 450 applications for the World Bank, Asia Infrastructure and Investment Bank and Council of Europe Development Bank loan requests, resulting in loan disbursements to 214 companies. The Bank was involved in the management of the companies’ environmental and social risks through experts’ field visits and independent audit process.

Loan Disbursements Following an Environmental and Social Risk Assessment

2023 Risk Score Distribution |

||||||

Credit Source |

No. of Companies |

Loan Amounts (USD) |

||||

A |

B |

C |

A |

B |

C |

|

IBRD |

0 |

77 |

38 |

0 |

58,826,707 |

31,583,763 |

AIIB |

0 |

16 |

6 |

0 |

78,354,490 |

16,009,070 |

CEB |

3 |

60 |

14 |

1,525,695 |

48,448,334 |

9,607,524 |

Total |

3 |

153 |

58 |

1,525,695 |

185,629,531 |

57,200,357 |